Evaluation of the European Space Agency Contribution Program of the Canadian Space Agency

For the period from to

Project # 17/18 – 02-03

Prepared by the Audit and Evaluation Directorate

Table of contents

- List of tables and figures

- Acronyms used in the report

- Executive Summary

- 1. Introduction

- 2. Description of the ESA-CP

- 3. Evaluation approach and methods

- 3.1 Purpose and scope

- 3.2 Methods

- 4. Evaluation findings

- 5. Conclusions and recommandations

- Management Response and Action Plan

- Appendix A: Bibliography

List of tables and figures

- Table 1: Summary of resources allocated to the ESA-CP

- Table 2: Distribution of interviews conducted

- Table 3: Distribution of ESA contracts to the Canadian space sector

- Table 4: Return coefficient for Canada

- Figure 1: Relationship among ESA, Canada, and the CSA

- Figure 2: Agreement, Declarations, and Arrangements

- Figure 3: ESA-CP Logic Model

- Figure 4: Distribution of Canadian space exports revenues by regions

- Figure 5: Value of contracts to all ESA member states

- Figure 6: Value of contracts to Canada

- Figure 7: Distribution of contracts by size of contracts

- Figure 8: Distribution of contract value to Canada per fiscal year

- Figure 9: Distribution of contracts among the Canadian space sector

- Figure 10: Overall coefficient of ESA members

Acronyms used in the report

- CETA: Canada-European Union Comprehensive Economic and Trade Agreement

- CNES: Centre national d'études spatiales (France)

- CSA: Canadian Space Agency

- ESA: European Space Agency

- ESA-CP: European Space Agency Contribution Program

- GAC: Global Affairs Canada

- GSTP: General Support Technology Program

- ISED: Department of Innovation, Science and Economic Development

- ITAR: International Traffic in Arms Regulations (US)

- JAXA: Japan Aerospace Exploration Agency

- LEO: Low Earth Orbit

- NASA: National Aeronautics and Space Administration

- R&D: Research and development

- SDR: Special Drawing Rights

- STDP: Space Technology Development Program

- TRL: Technology Readiness Level

- TRP: Technology Research Programme

Executive Summary

This report presents the findings of the evaluation of the Canadian Space Agency (CSA)'s European Space Agency Contribution Program (ESA-CP). The primary purpose of the ESA-CP is to allow Canadian entities, predominantly the Canadian space industry, to participate in space missions and activities undertaken by the European Space Agency (ESA). The evaluation covers a five-year period, from to , and examines the relevance and performance of the ESA-CP.

The evaluation was conducted by PRA Inc., on behalf of the CSA's Audit and Evaluation Directorate, between and . The evaluation is included in the CSA's five-year evaluation plan and was conducted in accordance with the Treasury Board of Canada's Policy on Results ().

Relevance

There is a strong rationale for Canada to maintain its long-standing participation in ESA programmes and activities. Access to foreign markets is a cornerstone component of Canada's space program, and while the United States remains a key partner, the range of missions and activities in which the Canadian space sector can engage through ESA programmes in uniquely beneficial. The European Union, and an increasing number of European countries, are expanding their involvement in space missions and activities, and are counting on ESA to implement a large portion of those. In the absence of the framework created by the Canada-ESA Cooperation Agreement and the ESA-CP, the Canadian space sector could not meaningfully engage in these projects. The very policy that drives the entire procurement process of ESA leaves very little room for a non-member country to participate in these missions and activities, creating de facto a highly protected market. Moreover, Canada's track record confirms that the Canadian space sector is capable of successfully competing for contracts issued by ESA, therefore providing opportunities for the Canadian space sector to advance its capabilities in a range of space technologies, which in turn, can support missions and activities undertaken by the CSA.

As of , the CSA must align its procurement policies with the requirements of the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), providing some opportunities for the European space sector to bid on CSA contracts. While some uncertainties remain, the Canadian space sector should also have access to some opportunities, beyond ESA (which is not covered by CETA), to bid on European space-related contracting opportunities. These pressures to further integrate the Canadian and European space markets emphasize the need for the Canadian space sector to actively engage with European space actors, something that is highly supported through Canada's participation in ESA.

As it supports knowledge-based and innovative economic activities, and strengthens the Canadian space sector's ability to engage in foreign markets, the ESA-CP is directly aligned with federal priorities. In addition, since Canada selects the range of optional programmes in which it wishes to engage, the ESA programming framework allows the CSA to further align the range of missions and activities in which the Canadian space sector can engage, to also support its own priorities.

Performance

During the five years covered by the evaluation, ESA signed a total of 168 contracts with the Canadian space sector, valued at a total of €75.8 million, representing approximately $115 million, or $23 million annually on average. A total of 41 companies received 92% of the value of these contracts, whereas 15 universities and two federal departments shared the remaining portion. As of , Canada's return coefficient, as calculated by ESA, stood at 1.06, confirming the ability of the Canadian space sector to successfully bid in sectors where its expertise is sought.

These results confirm that the ESA-CP is achieving one of its primary objectives, which is to allow the Canadian space sector to be actively engaged and to collaborate with European space actors, including the large European prime contractors of ESA. This environment has also facilitated the involvement of Canadian scientists in ESA missions.

Beyond its direct participation in ESA missions and activities, the ESA-CP is strengthening the ability of the Canadian space sector to engage in other foreign space markets. For instance, during the period covered by the evaluation, MDA has successfully capitalized on expertise gained through ESA contracts to position itself in Low Earth Orbit constellation projects, including the one led by OneWeb. In the field of space exploration, companies such as MDA, Calm technologies, and SED (Calian) have also built on expertise gained through ESA to engage or to position themselves for existing or planned deep space missions, which is emerging as a global priority for space agencies around the world. In the field of Earth observation, COM DEV has built on expertise gained through ESA contracts to secure a commercial opportunity with the Japan Aerospace Exploration Agency (JAXA), and Communications & Power Technologies (CPI) has successfully engaged in an ESA programme in which Canada does not formally participate as a result of the unique expertise it can provide. For the Canadian space sector, the access to the ESA market is seen as pivotal to both engage in ESA missions and activities, and to position itself for other foreign markets.

The cooperation agreement between Canada and ESA, and the ESA-CP, is also providing the CSA with a privileged access to information and detailed insights on the evolving European participation in space activities, including both the missions and activities carried out by ESA, but also those carried out individually by European space agencies, or by the European Union.

With a long history of program implementation, the ESA-CP is efficiently delivered. The roles and responsibilities are clearly defined, and for every dollar that Canada invests in the ESA-CP, the Canadian space sector is receiving $0.73 in contracts from ESA. Considering the scope, range and complexity of ESA missions and activities, and the benefits achieved, this is seen as a strong return for Canada.

Moving forward, the successful consultations held by the CSA with the Canadian space sector prior to the meeting of the ESA Council at the Ministerial Level provides a strong foundation for supporting Canada's planning activities in anticipation of the meeting of the ESA Council at the Ministerial Level. As the space sector continues to evolve and attract companies interested in engaging in new space commercial opportunities, the goal of opening these consultations as widely as possible remains highly relevant. Beyond these consultations, the evaluation also identified an opportunity for the CSA to facilitate the sharing of experiences and lessons learned among the Canadian space sector working within the ESA context. This would be particularly beneficial for new entrants among the Canadian space sector.

1. Introduction

This document constitutes the final report of the evaluation of the Canadian Space Agency (CSA)' European Space Agency Contribution Program (ESA-CP). The fundamental purpose of the ESA-CP is to allow Canadian entities, predominantly the Canadian space industry, to participate in space missions and activities undertaken by the European Space Agency (ESA). With 22 member states, approximately 2,200 staff members and a budget that stood at €5.75 billion in , ESA is among the largest space agencies in the world, and is mandated to undertake a wide range of technology development, data use, and operational activities that strengthen Europe's space capability (ESA, 2017a). In particular, ESA supports the implementation of some of the European Commission's flagship projects in the areas of global navigation, Earth observations, communications, and space situational awareness (European Commission, 2018b).

In carrying-out its activities, ESA operates under the driving principle that any contracted work should, to the extent possible, be allocated to industries located among its member states, based on the financial contribution of these member states to the ESA budget. Under a long-standing agreement, Canada has been participating in ESA programmes as the only non-European cooperating state, meaning that the Canadian space industry has been allowed to bid and, when successful, participate in these European missions and activities. The ESA-CP is the programming means by which Canada's participation has been implemented, playing a complementary role to the cooperation agreement signed by Canada and ESA.

The evaluation covers a five-year period, from to , and examines the relevance and performance of the ESA-CP. It is part of the CSA's five-year evaluation plan and was conducted in accordance with the Treasury Board of Canada's Policy on Results.

The evaluation was conducted by PRA Inc. on behalf of the CSA Audit and Evaluation Directorate, between and .

2. Description of the ESA-CP

This section of the report includes a brief description of the ESA-CP and of the broader context in which it operates. It covers the ESA-CP's key components, governance model, resource allocation, and expected outcomes.

2.1 The broader context of the ESA-CP

2.1.1 Canada's involvement in European space activities

For the past 50 years, Canada and Europe have pursued various forms of collaboration on space-related matters. Back in , Canada joined, as an observer, the European Space Conference, a ministerial-level organization that was tasked with determining future European space activities. Not long after, Canada, the US and the European Space Research Organization successfully collaborated on a communications satellite mission expanding broadcasting capabilities. During the same period, Canada joined a working group established by the European Space Conference exploring policy options around the uses of outer space. Following the formal establishment of ESA in , Canada considered several options for engaging with the newly created organization. This process led to the signing, in , of the first Canada-ESA Cooperation Agreement (Canada & ESA, ; Dotto, ). At the time of the evaluation, the agreement had been renewed four times (, , , and ), ensuring that the collaboration between Canada and ESA remained uninterrupted during the entire period.

Many factors have motivated Canada's efforts to expand its collaboration on space with Europe, including the need to diversify the range of partnerships in which Canada is engaged, the desire to strengthen the collaboration with Europe in critical areas of science and technology, and the recognition that Canada, with its population size, needs strong external markets to build and grow a sustainable national space industry (Leclerc & Lessard, ; Dotto, ).

To this day, external markets remain pivotal for the Canadian space industry. As of , total revenues for the Canadian space sector stood at $5.5 billion (CSA, , p. 26). A total of 36% of these revenues, namely $2 billion, was generated from exports to foreign markets, including the European market.

2.1.2 European trends in space activities

The same year that Canada and ESA signed their first cooperation agreement, the European Parliament adopted its first resolution concerning the participation of the European Community (later to be known as the European Union) in space research. Among other things, the European Parliament asked the European Commission "to consider research activities within the framework of the development of an overall Community policy for science and technology, by establishing relations with the ESA with a view to the coordination of space research programmes with Community projects" (European Parliament, , p. 42).

This marked the beginning of a lengthy and complex process towards the establishment of a shared vision on Europe's involvement in space, and on the appropriate distribution of roles and responsibilities between the European Union, ESA, and individual European countries, particularly those with active space agencies. By the 1990s, Europe had reached an important milestone, as it initiated two flagship initiatives: the satellite navigation project (Galileo), and the Earth observation project (Copernicus) (Reillon, , pp. 9-10).

A number of other stepping stones have shaped the nature and scope of the European engagement in space activities. Of note for the purpose of this report is the framework agreement between ESA and the European Community that came into force in . This agreement paved the way for a closer collaboration between the two institutions for the development of a space policy, which was officially tabled in (Commission of the European Communities, ). The policy stressed, among other things, the need to build a strong and competitive space industry, based in Europe. More recently, in , the European Commission tabled the European Union's space industrial policy (European Commission, ), followed by a space strategy in (European Commission, ). One goal of the strategy is to ensure that the data produced by Galileo and Copernicus are fully integrated and used in space-based solutions designed in Europe. The strategy also mandates the European Commission to "step up its efforts to support space research and development (R&D) activities, in cooperation with Member States and ESA, and review its strategic approach to boosting the competitiveness of the European space sector" (European Commission, , p. 7).

In , the European Commission tabled a proposal for a €16 billion (approximately $24 billion) investment to further support the European Space Programme for the period to . The proposal's key objectives are to strengthen Europe's space industry, ensure its autonomous access to space, and simplify the governance of European space activities. Under this proposal, the European Commission "will continue to be responsible for managing the overall programme", and ESA "will remain a major partner in the technical and operational implementation of the EU space programme" (European Commission, 2018a). ESA directly responded to this proposal, by noting that the upcoming ESA Ministerial Council will put forward its own proposal to support a shared vision between the European Union and ESA, with the understanding that the ESA will "continue to be THE Space Agency of its Member States and for the European Union". As part of this process, ESA will explore "the potential involvement of the European Union in ESA optional programmes" (ESA, 2018e).

2.2 The ESA-CP

2.2.1 ESA-CP overview and objectives

At the time of the evaluation, the ESA-CP was included in the CSA's departmental Program entitled "Future Canadian Space Capacity" (CSA, 2017b, p. 47). With this Program, the CSA aims to enhance the capacity of the Canadian space sector through the development of space expertise in Canada (including the training of highly qualified personnel), the support to research and development activities in targeted space areas, and the access for the Canadian space sector to a broad range of international markets. The ESA-CP is focussing more specifically on that latter dimension, by targeting directly the European market, which in turn, may open up opportunities in other international markets.

From a strict point of view, the purpose of the ESA-CP is to provide the means by which Canada may fulfill its commitments contained in the most recent cooperation agreement it has signed with ESA back in . In other words, the ESA-CP and the cooperation agreement are mutually dependent on each other: there cannot be an ESA-CP in the absence of a cooperation agreement, and the commitments contained in the cooperation agreement cannot be met in the absence of the ESA-CP or another similar program.

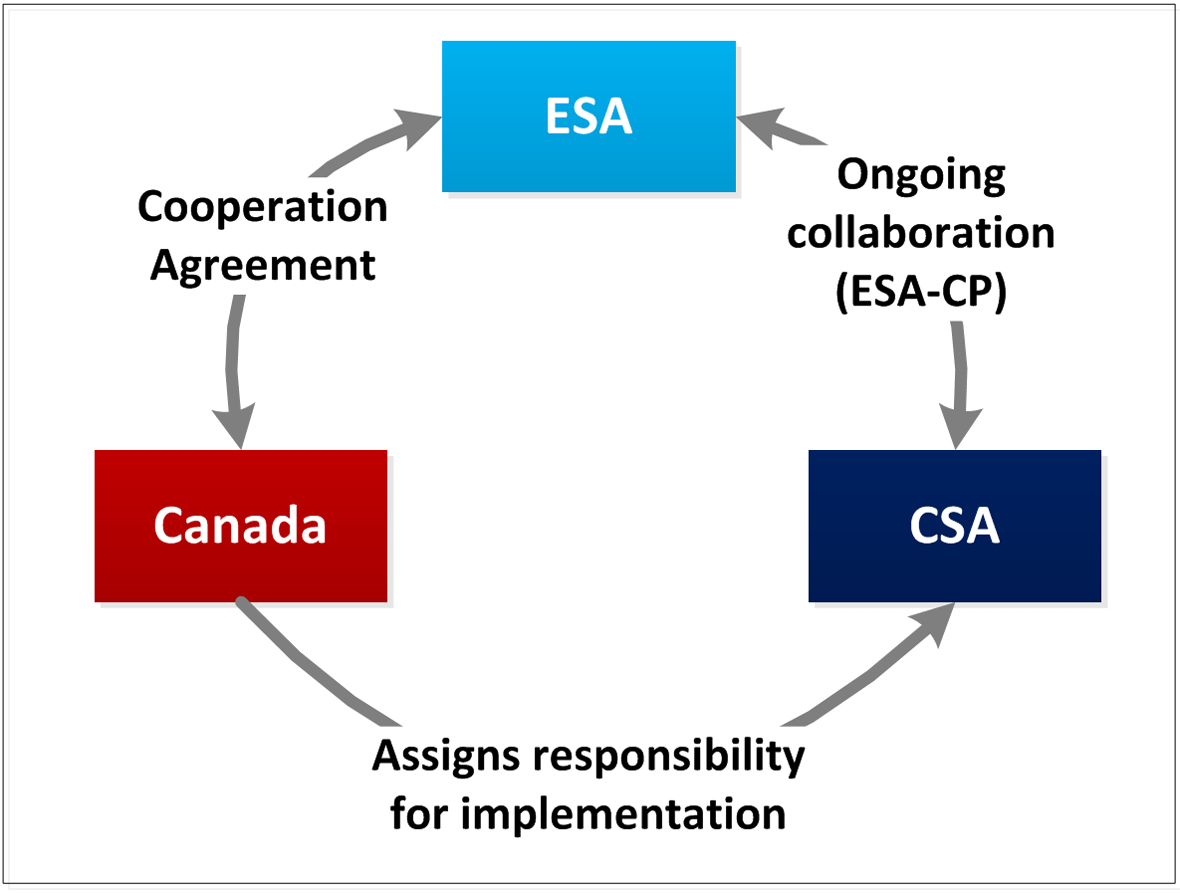

Figure 1

Figure 1 - Text version

Figure 1 represents a circle with three boxes: Canada, ESA and CSA. Between the boxes, arrows are described by the following statements:

- From Canada to CSA: unidirectional arrow: "Assigns responsibility for implementation"

- Between CSA and ESA: bidirectional arrow: "Ongoing collaboration (ESA-CP)"

- Between ESA and Canada: bidirectional arrow: "Cooperation Agreement"

Consequently, and as illustrated in Figure 1, the cooperation between ESA and Canada first requires that an agreement be signed between the two entities. This agreement engages the Government of Canada as an international treaty partner. Once this agreement is signed, the Government of Canada assigns the responsibility to the CSA to participate in the activities of ESA, which is achieved through the ESA-CP.

2.2.1.1 The Cooperation Agreement between ESA and Canada

The current agreement between Canada and ESA was approved by the ESA Council in and by the federal government in ; it was signed in Paris on ; and it was fully ratified on , which is the date it entered into force. As a result, the agreement covers the period between and (Canada & ESA, , sec. XIV; CSA, 2015a).Footnote 1

The agreement essentially sets the stage for the participation of Canada, and of the Canadian space sector, in the activities and affairs of ESA. As such, it contains few details, but rather establishes the driving principles through which the cooperation between Canada and ESA are to operate. For the purpose of this evaluation, the following provisions of the agreement are particularly relevant:

- General budget: ESA's general budget expenditures support mandatory activities and programmes, such as studies on future projects, the Technological Research Programme (TRP), technical investment, information systems and training activitiesFootnote 2, as well as other internal costs. Canada contributes to ESA's general budget, but cannot participate in the TRP. The level of contribution to ESA's general budget that is expected from each ESA member is scaled on the basis of the average national income of each member state. Since Canada is a cooperating state and does not participate in the TRP, its contribution rate to ESA's General Budget is set at half of what it would be if Canada was a full member state, and excludes the TRP.

- Optional Programmes: As part of its mandate, ESA implements a range of optional programmes in the fields of satellite communications, Earth observation, navigation, technology development, human spaceflight, microgravity and exploration, launchers, and space situational awareness. Canada may opt to participate in any one of these programmes, subject to the unanimous approval of all member states participating in each selected programme.

- Industrial return: In return for its contribution, Canada can expect an "industrial return", meaning that ESA commits itself to contracting Canadian entities (mostly industry, but could include universities or federal departments and agencies) as part of the development or operations of its missions and activities. For the Canadian contribution to its General Budget, ESA's goal is to provide a "fair industrial return". As for Canada's contribution to optional programmes, ESA's goal is to provide a level of industrial return that is set for each of these programmes, and applicable to all participating states.

- Affairs of ESA: In addition to the industrial return, Canada's contribution allows designated delegates from Canada to participate in the meetings of the ESA Council, the Programme Boards involved with each optional programme (as applicable to Canada), and all other committees and bodies as applicable. During those meetings, Canada has a right to vote on items related to optional programs in which it participates. Canada also has access to some reports and documentation pertaining to the programmes in which it is involved, in addition to studies conducted as part of ESA's general budget.

- Bilateral projects: In addition to the mandatory activities and optional programmes, ESA and Canada (or the CSA directly) may sign arrangements for bilateral projects, or for the exchange of personnel, but those are implemented outside of the Cooperation Agreement.

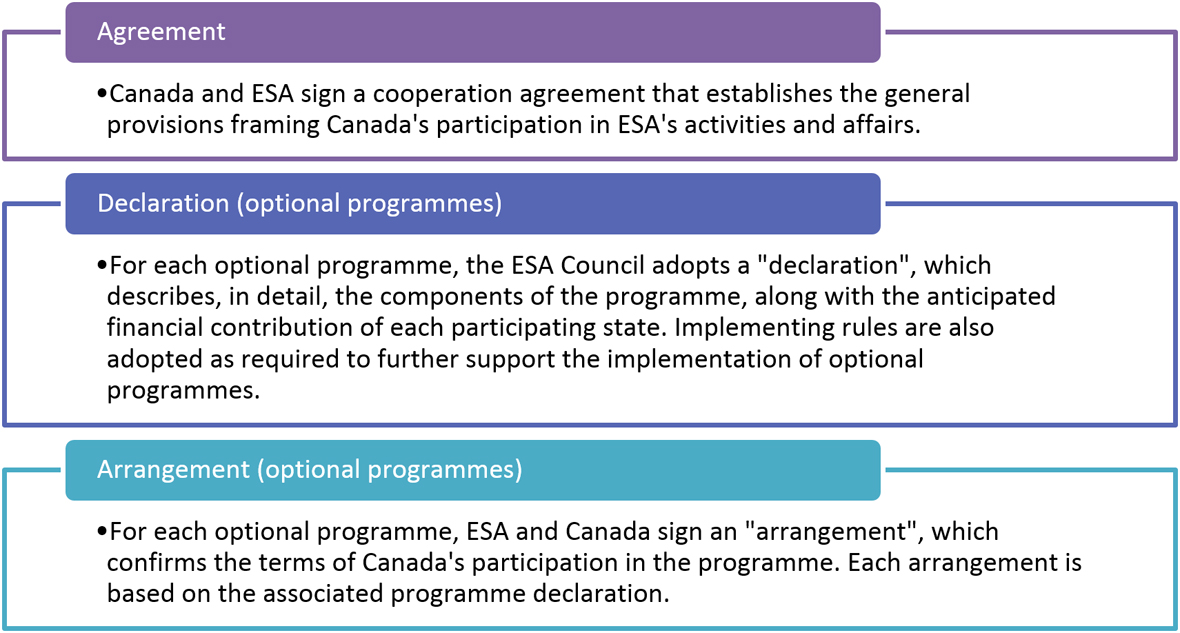

As illustrated in Figure 2, two other types of documents support the implementation of the cooperation agreement. The details related to the range of missions and activities undertaken under each optional programme are contained in Declarations, which are adopted and regularly revised by the ESA Council. These declarations describe each sub-component of the programme, the anticipated timeframe for their implementation, and the financial contribution expected from each participating state. On that basis, ESA and Canada sign, for each optional programme, an Arrangement, which is a brief document confirming the terms of Canada's participation, and referring to other program documents such as the program declaration. Arrangements are treaty-level documents that are legally binding under public international law.

Figure 2

Figure 2 - Text version

Figure 2 represents three boxes:

- Agreement

- Canada and ESA sign a cooperation agreement that establishes the general provisions framing Canada's participation in ESA's activities and affairs.

- Declaration (optional programmes)

- For each optional programme, the ESA Council adopts a "declaration", which describes, in detail, the components of the programme, along with the anticipated financial contribution of each participating state. Implementing rules are also adopted as required to further support the implementation of optional programmes.

- Arrangement (optional programmes)

- For each optional programme, ESA and Canada sign an "arrangement", which confirms the terms of Canada's participation in the programme. Each arrangement is based on the associated programme declaration.

2.2.1.2 The ESA-CP

Consistent with the purpose of the cooperation agreement, and as established in its Terms and Conditions, the ESA-CP pursues the following objectives:

- Foster innovation and competitiveness by exposing Canadian space organisations to ESA's programmes and activities dedicated to developing space technologies, applications and hardware;

- Maintain or increase the capability of the domestic space sector to successfully contribute to Canadian space endeavours by providing access to ESA's space flight opportunities in order to demonstrate and qualify Canadian space technologies and hardware;

- Facilitate access to European public space markets as well as global space public and private markets, when applicable; and

- Acquire and maintain awareness of the directions of European space policies and of the European space technological, scientific, programmatic and commercial environments to feed the CSA's strategic planning process.

In addition, Canadian participation in ESA programmes may:

- Facilitate the participation of Canadian scientists to ESA missions; and

- Facilitate access to ESA's data and/or infrastructures meeting the needs of academia and government departments /agencies.

The ESA-CP pursues these objectives by supporting the implementation of the cooperation agreement, through financial contributions towards ESA's general budget and the optional programmes, in addition to participating in the affairs of ESA in accordance with the cooperation agreements, the declarations, and the arrangements specific to each optional programme.

2.2.2 Program resources

Over the five years covered by the evaluation, the CSA invested a total of $161.1 million in the ESA-CP.

As indicated in Table 1, practically all these resources (98%) were directed toward contributions to ESA's general budget and the optional programmes, while the remaining covers the expenditures incurred by the CSA for the management of the program. A more complete analysis of these numbers is included in Sub-section 4.2.3 of this report. As for human resources, an average of 3.6 full time equivalents (FTE) were assigned annually to the ESA-CP.

| Activities | - | - | - | - | - | Total |

|---|---|---|---|---|---|---|

| Contribution to ESA | ||||||

| General budget | 8,528 | 9,933 | 9,963 | 9,614 | 9,899 | 47,938 |

| Optional programmes | 16,093 | 19,830 | 17,839 | 24,884 | 31,867 | 110,514 |

| Sub-total | 24,621 | 29,763 | 27,803 | 34,499 | 41,766 | 158,452 |

| Management of ESA agreement | ||||||

| Number of FTEsTable 1 note * | 3.4 | 3.1 | 4.2 | 3.8 | 3.5 | - |

| Salaries | 380 | 393 | 491 | 443 | 458 | 2,165 |

| O&M (excluding contracts) | 75 | 80 | 105 | 112 | 113 | 484 |

| Sub-total | 455 | 473 | 596 | 555 | 571 | 2,650 |

| Total | 25,076 | 30,236 | 28,399 | 35,053 | 42,337 | 161,101 |

Table 1 notes

- Table 1 note 1

-

FTE: Full Time Equivalent

Source: Financial data provided by the CSA

2.2.3 Management structures

The ongoing management of both the cooperation agreement and the ESA-CP engages the CSA, Global Affairs Canada (GAC) and ESA. For the purpose of this report, these responsibilities may be summarized as followFootnote 3:

- CSA: The Space Science and Technology Branch of the CSA is largely responsible for the ongoing management of the ESA-CP. As such, it normally represents Canada on the ESA Council and other management structures of ESA; it manages the CSA financial contributions to ESA; it liaises with Canadian delegates who sit on the applicable ESA optional programme boards (these delegates may come from various branches of the CSA and may include experts from other federal departments and agencies); it organizes consultations with industry and prepares recommendations for Canada's participation in optional programmes; and it monitors the ongoing implementation of the program, including the level of industrial return achieved through mandatory activities and optional programmes. Other branches of the CSA support the implementation of the ESA-CP as required, for instance during the renewal of the cooperation agreement.

- GAC: Since the cooperation agreement and the program arrangements are international treaties engaging Canada, GAC collaborates with the CSA to negotiate and implement the agreement, including securing the required Orders in Council for the various arrangements establishing Canada's participation in optional programmes. The permanent Canadian delegate to ESA, who is based in Paris, also reports directly to GAC, while also working for the CSA.

- ESA: The ESA Council, in which Canada participates along with all member states, establishes the overall vision and direction of ESA activities, including missions and projects in which ESA is engaged. In doing so, it takes into account a range of considerations, such as the framework agreement between ESA and the European Union, the European space policy, or other ESA policies established in previous Council meetings. Once the mandatory activities and optional programmes have been set, the ESA personnel, under the responsibility of the Director General, is responsible for the ongoing implementation of these activities. Of particular significance for this evaluation is the fact that the entire procurement process required to support the implementation of these activities is solely managed by ESA. Selected contractors, including Canadian contractors as applicable, report directly to ESA, and not to member state space agencies such as the CSA. It should also be noted that for some programs (more specifically the General Support Technology Program (GSTP) and ARTES), ESA requires a letter of support from the concerned delegation prior to awarding a contract, to confirm the availability of funding and the alignment with the delegation priorities.

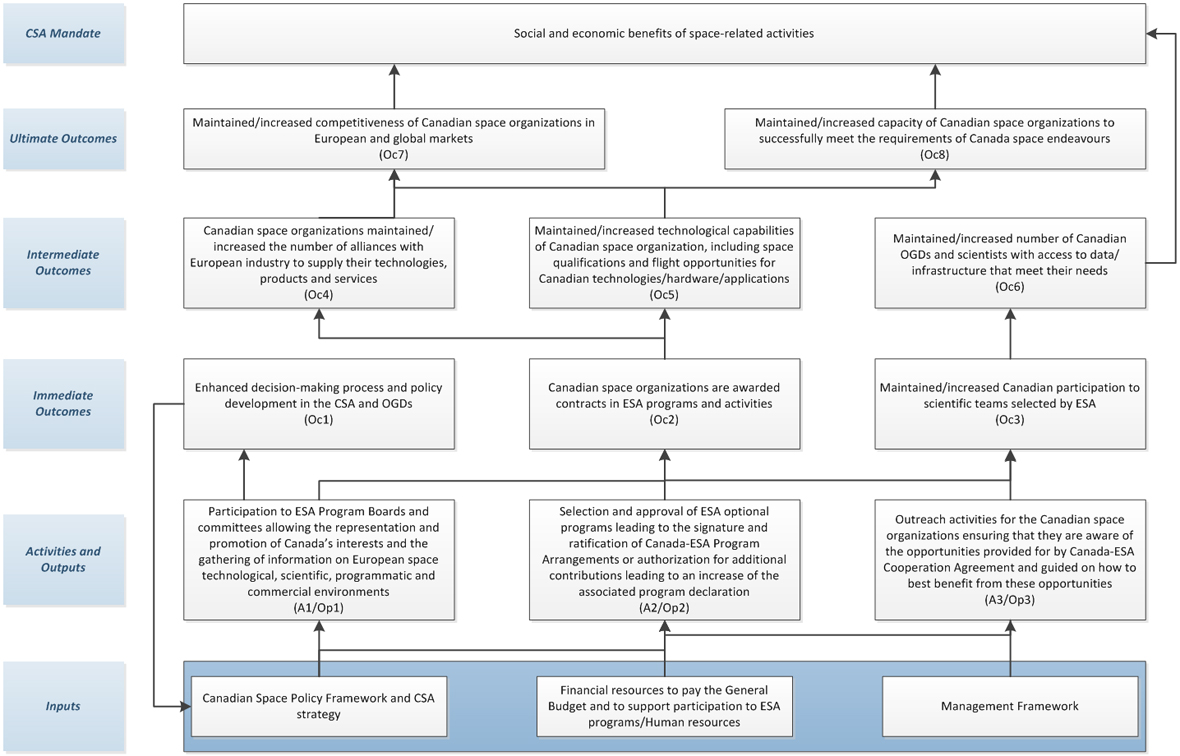

2.2.4 Program logic

The logic of the ESA-CP is described in its Performance Measurement Strategy (CSA, ). The logic model, which illustrates the ESA-CP's results chain, is presented in Figure 3.

ESA Program Logic Model

Figure 3

Figure 3 - Text version

ESA Program Logic Model

- CSA Mandate: Social and economic benefits of space-related activities

- Ultimate outcomes

- (Oc7) Maintained/increased competitiveness of Canadian space organizations in European and global markets (arrow to the CSA's mandate)

- (Oc8) Maintained/increased capacity of Canadian space organizations to successfully meet the requirements of Canada space endeavours (arrow to the CSA's mandate)

- Intermediate outcomes

- (Oc4) Canadian space organizations maintained/increased the number of alliances with European industry to supply their technologies products and services (arrow to the two ultimate outcomes)

- (Oc5) Maintained/increased technological capabilities of Canadian space organization, including space qualifications and flight opportunities for Canadian technologies/hardware/applications (arrow to the two ultimate outcomes)

- (Oc6) Maintained/increased number of Canadian OGDs and scientists with access to data/infrastructure that meet their needs (arrow to the CSA's mandate)

- Immediate outcomes

- (Oc1) Enhanced decision-making process and policy development in the CSA and OGDs (arrow to the first input)

- (Oc2) Canadian space organizations are awarded contracts in ESA programs and activities (arrow to Oc4 and Oc 5)

- (Oc3) Maintained/increased Canadian participation to scientific teams selected by ESA

- Activities and Outputs

- (A1/Op1) Participation to ESA Program Boards and committees allowing the representation and promotion of Canada's interests and the gathering of information on European space technological, scientific, programmatic and commercial environments (arrows to Oc1, Oc2 and Oc3)

- (A2/Op2) Selection and approval of ESA optional programs leading to the signature and ratification of Canada-ESA Program Arrangements or authorization for additional contributions leading to an increase of the associated program declaration (arrow to Oc2 and Oc3)

- (A3/Op3) Outreach activities for the Canadian space organizations ensuring that they are aware of the opportunities provided for by Canada-ESA Cooperation Agreement and guided on how to best benefit from these opportunities (arrow to Oc2 and Oc3)

- Inputs

- Canadian Space Policy Framework and CSA strategy (arrow to each activity/output)

- Financial resources to pay the General Budget and to support participation to ESA programs/Human resources (arrow to each activity/output)

- Management Framework (arrow to each activity/output)

3. Evaluation approach and methods

This section of the report provides a brief description of the methodology used to conduct the evaluation of the ESA-CP. It clarifies the purpose and scope of the evaluation, describes the key evaluation issues being addressed, and the methods used to gather evaluation findings. It also identifies the limitations that the evaluation faced, along with the strategies used to mitigate these limitations.

3.1 Purpose and scope

This report fulfills the commitment included in the CSA's Departmental Evaluation Plan (- to -) to conduct the evaluation of the ESA-CP. It covers a five-year period, from - to - and covers the relevance and performance of the ESA-CP. The following eight evaluation questions are addressed:

| Relevance |

|

|---|---|

| Performance |

|

3.2 Methods

Evaluation data were collected through a number of research methods, which are briefly described in this sub-section.

3.2.1 Overall approach

The CSA evaluated the ESA-CP in and (CSA, , 2015a). In this context, the primary objective of this evaluation is to complement what emerged from these previous assessments, allowing for a broader perspective to emerge on the expected rationale and benefits of this initiative. Along the same logic, and as applicable, this evaluation limits the description of findings that simply reflect what has already been documented in previous evaluations, while ensuring that the report remains a stand-alone document.

The full assessment of the ESA-CP requires that we consider the structures and processes of ESA, the cooperation agreement, and the contribution program itself. However, the primary focus of this evaluation remains the experience of the Canadian space sector in engaging with ESA missions and activities, and on the extent to which this participation supports the vision and departmental priorities of the CSA and, more generally, of the federal government. In other words, this report provides an evaluation of the Canadian collaboration with ESA, and not an evaluation of ESA itself.

The following sub-sections describe each of the methods used to address the evaluation questions.

3.2.2 Document, performance and financial data review

The review of administrative, performance, and financial data informed all evaluation questions. The document review portion of this task included both information publicly available or provided by the CSA on the ESA-CP, as well as documents provided by other stakeholders interviewed as part of the evaluation. As it relates more specifically to performance data, the CSA approved the ESA-CP's Performance Measurement Strategy in . As such, some but not all performance indicators had been documented at the time of the evaluation. Other information sources, such as ESA's performance data provided to the CSA, were used to provide additional insights on the ESA-CP. The performance information also included a variety of operational documents, administrative data, and financial information.

3.2.3 Key Informant Interviews and case studies

Key informant interviews contributed to the in-depth understanding of ESA-CP activities, including results achieved and challenges faced by key stakeholders. These interviews also corroborated, explained, or further elaborated on findings from other data sources. A total of 53 individuals were consulted (through both individual and group interviews) from five different stakeholder groups. The distribution of these interviews is included in Table 2.

| Key informant groups | # of individuals |

|---|---|

| CSA representatives | 13 |

| Other federal departments and agencies | 4 |

| Industry representatives | 17 |

| ESA representatives | 12 |

| Academia | 7 |

| Total | 53 |

A total of 13 of the interviews conducted focussed specifically on one of the seven case studies completed as part of this evaluation. As applicable, these interviews covered only the mission or project selected as case studies, or included both the case study and more general questions about the ESA-CP.

The criteria used to select the case studies included the type of ESA activity or optional programme through which they were funded, the Canadian partners involved in the activity or mission, the period during which the activity or mission was implemented, with the goal of covering a variety of experiences and outcomes.

3.2.4 Limitations

This section describes the key limitations encountered in the evaluation and how they were addressed.

Distribution of roles and responsibilities

As previously noted, ESA is responsible for delivering the activities funded through the ESA-CP in which Canada participates. As a result, it also determines the range, the format, and the frequency of reporting activities, which do not always align with the standard approach used by the CSA. For instance, the fiscal year of ESA is aligned with calendar year, instead of the April 1st to March 31st cycle used within the federal government. To the extent possible, the data was reconciled, or the difference is directly noted. Overall, this limitation has not had a significant impact on the extent to which performance information from ESA could be used to assess the ESA-CP.

Reporting requirements

Since Canadian entities (predominantly the Canadian space industry) that are engaged in carrying-out ESA requirements typically act as sub-contractors of larger prime companies, there is limited information available on the actual work they undertake, as ESA deals directly with the prime contractor, not the Canadian company (or other entities as applicable). As a result, interviewees from the CSA and ESA could only provide limited insights on the detailed impact of these contracts on Canadian entities. Only interviews conducted directly with Canadian companies (or other entities as applicable) could provide these insights.

Performance measurement strategy development

The ESA-CP performance measurement strategy was developed and approved in . Consequently, the data collected at the time of the evaluation addressed only some of the performance indicators. In addition, the CSA was in the process of implementing the new reporting structure established by the Policy on Results (Government of Canada, 2016b), particularly through the required Performance Information Profiles, which provide a new structure for gathering and reporting performance information. As a result, the evaluation gathered all available administrative data, including data provided by ESA, and proceeded with the required analysis to be included in this report.

4. Evaluation findings

This section of the report describes the evaluation findings. It first explores the relevance of the ESA-CP, before turning to its performance.

4.1 Relevance

4.1.1 The rationale for the ESA-CP

Finding: Considering the range activities undertaken by ESA, its protective procurement strategy, and the range of benefits that the Canadian space sector may expect from its participation in ESA programmes and activities, there is a strong rationale for maintaining the participation of Canada in ESA. This is a foreign market that significantly contributes to the growth and sustainability of the Canadian space sector. (Evaluation question: Relevance #1)

4.1.1.1 The perceived value of the partnership

With a history that now goes back almost 40 years, the ESA-CP has become a well-established component of Canada's space program. As noted in introduction, it emerged as a policy and programming option to support a greater level of diversification in space partnerships and to secure a much needed foreign market for Canada's space industry. Both the and evaluations of the ESA-CP concluded that the program's rationale was still holding true (CSA, , 2015a). Among the key drivers noted in these two evaluations are the following:

- The broad nature and scope of missions and activities undertaken by ESA offer opportunities for the Canadian space sector to advance its expertise and technology (including flight test and space qualifying activities for emerging R&D components) in a scale that could not be achieved solely through the missions and activities undertaken by the CSA;

- While the US remains an important partner for Canada, its approach to mission development, along with the regulatory framework in place, particularly the International Traffic in Arms Regulations (ITAR), limit the range of projects in which NASA can collaborate with the Canadian space sector.

- The Canadian space industry has particular niches of expertise (e.g., satellite communications and robotics) in which it is sufficiently competitive to successfully participate in contracted projects put forward by ESA, making the ESA-CP a meaningful option for the Canadian space industry.

- Since the space sector tends to be protectionist, and considering the industrial policy in place at ESA (contracts given to participating members), it is unlikely that the Canadian space sector could engage to any meaningful extent in projects undertaken by ESA in the absence of the cooperation agreement and the ESA-CP.

- Canada's participation in ESA programmes provide opportunities for Canadian scientists (from both government and academia) to participate in significant scientific projects, have privileged access to the resulting data, and forge new collaborations with European scientists.

These views were equally shared by stakeholders consulted as part of this evaluation. In particular, the Canadian space industry remains confident that it can provide a range of expertise that European prime contractors value and require to carry-out the large-scale projects managed by ESA. The Canadian scientists perceive their participation in ESA projects very favourably, including the range of collaborations it facilitates in technology development and scientific projects. Finally, ESA representatives perceive Canada as a longstanding and important partner of Europe, bringing a unique perspective based on Canada's proven track records in key technology development areas and its experience with other space agencies, notably NASA. As one ESA representative put it: "Canada brings in a top class industry, and a different sort of perspective on the way to do things, which is not European, and is refreshing with respect to some of our established approaches".

4.1.1.2 The current driving forces

The European space market

As noted in introduction, the Canadian space sector's growth and sustainability requires access to foreign markets. While the US market remains dominant in that regard, Europe occupies a critical position, as evidenced by the fact that close to a quarter of the $2 billion generated in in export revenues (representing $470 million), was generated from the European market (see Figure 4).

| US | Europe | Asia | Other regions | |

|---|---|---|---|---|

| Distribution | 46.2% | 23.7% | 14.6% | 15.5% |

Source: CSA State of Canadian Space Sector Report

Another important dimension is the fact that the Canadian space sector remains fairly contained, as 97% of the revenues it generates comes from the top 30 space organizations in the country, predominantly private industry (CSA, , p. 18). Moreover, the vast majority (90%) of export revenues for the Canadian space industry comes from sales to non-government customers, and relate primarily to manufacturing, satellite operations, as well as products and applications (CSA, , p. 30). In a market that was valued at $384 billion (US dollars) worldwide in (Space Foundation, ), the Canadian space industry must therefore position itself strategically, based on its competitive strengths.

One common scenario when it comes to foreign markets, particularly in the space manufacturing sector, is for the Canadian space industry to act as sub-contractors, providing components for foreign prime companies, as opposed to complete end-to-end systems (CSA, , p. 30). The fact that the European space manufacturing sector generated €8.8 B (approximately $13.3 billion) in sales in , which does not include other lucrative segments such as satellite communications-based services, provides further illustration of the strategic importance of the European market for Canada. And the fact that €3.5 billion of these sales came from ESA, by far the most important institutional client of the European space manufacturing industry (ASD-Eurospace, ), leaves little doubt as to the advantage given to industries from ESA member countries in accessing this market.

The European Union, ESA, and Canada

Among the many dynamics that have shaped the European space market is the evolving and complex relationship between ESA and the European Union, which has consistently raised questions as to its potential impact, positive or negative, on Canada's involvement with ESA, and with space activities in Europe more generally. Among the many complicating factors relevant to this evaluation is the fact the ESA and the European Union have different memberships (including many nations that belong to both), and perhaps more importantly, they operate with completely different procurement policies and procedures. Both the and evaluations of the ESA-CP raised questions on the potential impact that this evolving relationship may have on the Canadian space sector.

At this point, Canada is actively engaged as a participating state in ESA, and is also actively engaged with the European Union, particularly through the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), whose scope far exceeds space, but does include it nonetheless. CETA was officially signed in , and provisionally appliesFootnote 4 since (Global Affairs Canada, 2017a), which falls within the period covered by this evaluation. What is known about CETA and its application to space is the following:

- Since ESA is an international organization that is not technically included in the European Union, none of its procurement practices are affected by the application of CETA.

- The procurement policies of a number of federal departments and agencies, including the CSA, must now align with the requirements of the trade agreement. In the specific case of the CSA, it must first be noted that any procurement activities associated with goods and services valued at less than approximately $220,000Footnote 5

- are excluded from the requirements of CETA. As for activities valued at more than $220,000, "the procurement of covered goods and services is limited to those related to satellite communications, earth observation and global navigation satellite systems. This commitment is in effect for a five-year period following the entry into force of this Agreement" (Global Affairs Canada, 2017a, secs. 19-A).

- Defence-related and R&D procurement activities, in both Canada and the European Union, are not covered by the requirements of CETA (Global Affairs Canada, 2017b).

What remains less clear is the extent to which the Canadian space industry is currently in a position to bid on eligible procurement activities undertaken by the European Union, and national space agencies in Europe, particularly the larger agencies such as those in France, Germany, and Italy. None of these space agencies are in the list of public European authorities included in the CETA agreement (Global Affairs Canada, 2017a, secs. 19-B). For instance, in the specific case of France, the Académie des technologies, the Agence de biomédecine, and the Centre national de la recherche scientifique are among the entities covered by CETA, but not the Centre national d'études spatiales (CNES), which is France's space agency. During interviews conducted as part of this evaluation, stakeholders agreed that the precise scope of CETA, particularly when it comes to its application to European space agencies (other than ESA) has yet to be clarified. Since the goal of the ESA-CP is to ultimately position favourably the Canadian space industry in international markets beyond ESA, this is an important consideration that will require close monitoring as all concerned parties gain experience under the trade agreement.

4.1.1.3 Is the ESA-CP still needed?

In light of the long history of collaboration between the CSA and ESA, it appears appropriate to somewhat reverse the question of whether the ESA-CP is still needed, by considering whether there is a strong rationale to end it. And the answer that emerged from this evaluation is that there is no such rationale. In fact, evaluation findings indicate that the greater integration of activities between ESA and the European Union, as well as the greater integration of economic activities between the European Union and Canada provide a strong rationale for maintaining an active participation of Canada in ESA.

Ending the ESA-CP program would first exclude the Canadian space sector from participating, in any meaningful way, in the missions and activities of ESA. This is particularly important when considering the stated goal of ESA to "continue to be THE Space Agency of its Member States and for the European Union" (ESA, 2018e). Along the same lines, the ability of the Canadian space sector to benefit from the potential opportunities provided by CETA could arguably be negatively affected if Canada is no longer actively involved in discussions and projects involving European space partners sitting around the ESA table.

In sum, the initial drivers behind Canada's participation in ESA that were documented in the previous ESA-CP evaluations remain valid, and the vision of the European space sector that has emerged during the period covered by this evaluation both confirm the need for the ESA-CP.

4.1.2 The ESA-CP's alignment with government and CSA priorities

Finding: The ESA-CP has historically been aligned with the goal of the federal government to support R&D intensive sectors of the economy, and their involvement in foreign market. In addition, the fact that ESA offers optional programmes allow each participating member state, including Canada, to tailor its participation based on national priorities. (Evaluation question: Relevance #2)

Since the federal government has continuously promoted innovation, R&D, and trade opportunities, a program such as the ESA-CP logically aligns with federal priorities. In that sense, evaluation findings gathered as part of this evaluation largely echo the findings contained in the two previous evaluations of the ESA-CP, which emphasized the need to support and grow "an innovative and knowledge-based economy" (CSA, 2015a, p. 30)

In its mandate letter delivered to the Minister of Innovation, Science and Economic Development (ISED), the Prime Minister instructed the Minister to pursue the overarching goal of helping "Canadian businesses grow, innovate and export so that they can create good quality jobs and wealth for Canadians". The Prime Minister also expects ISED "to partner closely with the Minister of International Trade to help Canadian firms compete successfully in export market" (Government of Canada, ). As an agency that falls under the ISED portfolio, the CSA is supporting this goal through the ESA-CP. Not only is the space sector particularly R&D intensive (CSA, 2015a, p. 26), but it is a sector that provides the type of "good quality jobs" that are at the centre of the government's objective, with over 21,000 such jobs supported by the space sector in Canada in (CSA, , p. 4). Accessing the ESA market contributes to this outcome.

Evaluation findings also provided further insights on the alignment of the ESA-CP with the priorities of the CSA itself. An important consideration in that regard is the very structure of ESA activities. The fundamental principle behind ESA's operations is that the agency put forward a range of optional programmes, and member states decide in which of these programmes they wish to make a financial contribution in order for their space sector to participate in them. This, from the outset, provides an opportunity for each member state, including Canada, to shape their participation in ESA in such a way as to align it with its own priorities and vision for space activities.

Stakeholders consulted as part of this evaluation did emphasize the flexible nature of ESA programming, and also noted that, overall, the nature and range of activities undertaken by the CSA and ESA are largely aligned. In both cases, the agencies are not limiting themselves to a few niche areas, but are instead participating in a fairly wide range of space-related missions and activities, albeit with very different levels of resources.

This is significant not only for the Canadian space sector, but for the CSA more directly. Indeed, in order to pursue its programming priorities, the CSA requires sufficient levels of capacity within the Canadian space sector, which must provide the required spaceships, payloads, systems, and services (as applicable). By participating in missions and activities of ESA relating to technology development, Earth observation, satellite communications, space exploration, and, to some extent, navigation, the Canadian space sector builds knowledge and expertise that can be applied to missions and activities of the CSA. These capacity building efforts complement what the CSA is supporting through its own technology development programs such as the Space Technology Development Program (STDP) (CSA, 2017b, p. 53).

The area of scientific missions concerning the Sun-Earth system provides further illustration of this principle. The SWARM mission, launched by ESA in , examines the Earth's magnetic field and provides data that can support a number of applications in areas such as navigation systems, earthquake prediction and drilling for natural resources (ESA, 2018d). Canada participated in the development of this mission through its financial contribution to the EOEP program, which provided commercial opportunities for COM DEV, in addition to involving scientists from the University of Calgary. Upcoming missions to be led or co-led by ESA, such as the EarthCare mission (analysing clouds and aerosols), are also engaging the Canadian space industry and academia. In all these cases, the CSA is advancing its objectives under both the ESA-CP and the Sun-Earth System Science Business Line (CSA, 2017b, p. 11).

4.1.3 Appropriate distribution of roles and responsibilities

Finding: The roles and responsibilities for the implementation of the ESA-CP are clearly defined, and no issue of duplication emerged during the period covered by this evaluation. (Evaluation question: Relevance #3)

Consistent with the evaluation of the ESA-CP, findings gathered as part of this evaluation indicate that the ESA-CP operates within a clearly defined framework in terms of roles and responsibilities. In accordance with the Canadian Space Agency Act, the CSA is expected to actively promote the peaceful use and development of space through a range of missions and activities that can provide social and economic benefits to Canadians. In doing so, the Act provides the authority to the CSA to collaborate with other space agencies, and to provide financial contribution in support of this collaboration. In this context, the contribution of both GAC and the CSA in establishing the cooperation agreement between Canada and ESA provides the foundation upon which the ESA-CP can materialize this collaboration through the missions and activities in which the Canadian space sector engages in.

Interviews conducted as part of this evaluation further noted that the vast experience gained through the renewals of the cooperation agreement and of the ESA-CP has allowed all key stakeholders to gain a strong understanding of the distribution of roles and responsibilities. No issue of duplication or gaps in roles and responsibilities emerged from the evaluation findings.

4.2 Performance

The analysis of ESA-CP's performance begins with a summary of the activities undertaken through the evaluation period. This sets the stage for an adequate assessment of the broader results expected from the ESA-CP, namely its ability to provide strategic information that can assist the CSA and the Canadian space sector in planning and delivering their space-based activities, and to position the Canadian space sector in engaging in ESA activities, and building on that experience to more generally engage at the international level.

4.2.1 ESA contracts to the Canadian space sector

Finding: During the evaluation period, ESA signed 168 contracts with the Canadian space sector, valued at €75.8 million, representing approximately $115 million, or $23 million annually on average. In total, 41 companies, 15 universities and two federal departments received contracts from ESA. As of , Canada's overall return coefficient stood at 1.06. (Evaluation question: Performance #3)

4.2.1.1 Key considerations

The data presented in this sub-section is largely based on reports provided by ESA to its member states. There are a number of differences in the way in which ESA and CSA monitor and report on their activities. For the purpose of this evaluation, the following considerations appear particularly relevant:

- Fiscal year: ESA's fiscal year is aligned with the calendar year, and reports are provided to member state on a quarterly and annual basis.

- Reporting period: To monitor the industrial return achieved by each member state, ESA establishes statistical periods. At the time of the evaluation, the applicable statistical period was from to . The previous one was from to . As a result, some of the statistics presented in this sub-section do not align perfectly with the period covered by the evaluation. In most cases, the data available covered the period from to . Appropriate references are included to confirm the period covered.

- Weighted value: ESA uses both weighted and un-weighted numbers when reporting on the value of contracts signed with the space sector of each member state, as applicable. The weighted numbers are adjusted using a technological weighting factor. Put simply, when contracts relate entirely to space technologies, the weighted ratio is 1.00 (no adjustment), but if a contract includes activities that are not related to space technology (e.g., general maintenance of an ESA facility), the weighting factor is adjusted accordingly (a contract of €1 million that would include only €500,000 in space technology would be weighted at a ratio of 0.50). The weighted value is typically more relevant under mandatory activities, since optional programmes tend to focus on the development of space technologies.

Return coefficient: As already noted, ESA' goal is to ensure that each member state receives a "fair return", through contracts given to its space sector, for the contribution it makes to the ESA budget. This is reported using a return coefficient, which is "the ratio between the share of a country in the weighted value of contracts, and its share in the contribution paid to the Agency" (ESA, 2018b). Keeping in mind that the ideal ratio is 1.00Footnote 6, ESA establishes lower limits for the cumulative return coefficient (grouping contracts for all mandatory and optional programmes and activities) to be achieved by each member state. For the current period ( to ), those lower limits are:

- 0.91 by

- 0.93 by

- 0.95 by

If a member state does not achieve this minimal level of return coefficient by the end of the statistical period ( in this case), ESA is expected to take specific measures to facilitate the achievement of this return level. Along the same line, if a member country exceeds 1.00 by the end of the period, the member country may have to augment its contribution to bring the coefficient back to 1.00.

4.2.1.2 Overview of contracts allocated during the current ESA reporting periodFootnote 7

Keeping these considerations in mind, ESA allocated a total of €16.2 billion (€13 billion weighted) in contracts to the space sector of its member states over the period from to . As illustrated in Figure 5, the largest portion in value of these contracts (35%) was in support of optional programmes falling under the domain of European launchers, considered an ESA priority during this period (ESA, 2018a). The domains of Earth observation and telecommunications, which have historically been particularly relevant to Canada, represented 25% of the total sum contracted out, whereas mandatory programmes and activities represented 13% of that sum.

| Value of contracts | |

|---|---|

| Launchers | 4,489 |

| Microgravity and human spaceflight |

3,065 |

| Earth observation | 1,938 |

| Mandatory programmes and activities |

1,640 |

| Telecommunications and navigation |

1,250 |

| Other (not yet assigned) |

629 |

Source: ESA geographical return statistics

During the same period (not the entire evaluation period), the Canadian space sector received €52.4 million (approximately $79.5 million) in contracts for activities related to ESA mandatory and optional programmes.Footnote 8 Figure 6 presents the distribution of these contracts by key domains of ESA programming.

| Value of contracts | |

|---|---|

| Microgravity and human spaceflight |

15.2 |

| Telecommunications and navigation |

14.6 |

| Earth observation | 12.1 |

| Mandatory programmes and activities |

6.9 |

| Other (not yet assigned) |

3.5 |

| Launchers | 0.1 |

Source: ESA geographical return statistics

A few considerations must be kept in mind when assessing these numbers:

- The Canadian space sector receives approximately 0.4% in value of all contracts provided by ESA to its member states. Consequently, even if ESA invests large sums in programmes in which the Canadian space sector is not particularly involved, such as launchers, it leaves significant contractual activities in all other areas targeted by the Canadian space sector. For instance, telecommunications was one of the domains in which ESA invested the least during the period reported in this evaluation and yet, €1.3 billion was contracted in telecommunications projects, including €15 million to the Canadian space industry (which represented 1.2% of the total amount contracted in this domain).

- Each period presents unique characteristics. For instance, the value in contracts to Canada for microgravity and human spaceflight represented 29% of the total amount directed to Canada, which is a higher portion than what would typically be seen in previous periods. In comparison, during the period reported in the previous evaluation of the ESA-CP ( to ), this domain represented 16% of all contracts provided to Canada. The same could be said of contracts related to mandatory programmes and activities. During the period reported in this evaluation, it represented 13% of the total value of contracts given to Canada. During the period reported in the previous evaluation, it stood at 30%, a much higher proportion that largely resulted from large contracts awarded to SED for the third deep space antenna.

- The amounts reported are the commitments made by ESA, meaning the total value of the contracts signed with the space industry. These contract are typically implemented over a fairly extended period of time, and the actual expenditures incurred by ESA, and thus the revenues received by the space sector, will equally span over a certain period of time. Put simply, the amounts reported do not represent what has been paid to the space sector, but rather what has been contracted.

- The contracts that have yet to be assigned relate to various optional programmes (ESA, 2018c, p. 10).

4.2.1.3 ESA contracts directed to the Canadian space sector during the evaluation period

Considering specifically the entire period covered by this evaluation, namely to , the Canadian space sector signed a total of 168 contracts associated to ESA projects, worth €75.8 million unweighted (approximately $115 million). Table 3 provides a breakdown of these contracts by ESA programming domains.

| Programming domains | # of contracts | Value € unweighted |

|---|---|---|

| Microgravity and human spaceflight | 21 | 26,990,683 |

| Telecommunication and navigation | 30 | 15,443,173 |

| Earth observation | 77 | 14,453,939 |

| Mandatory programmes and activities | 22 | 10,687,379 |

| Others (incl. not assigned) | 18 | 8,210,470 |

| Total | 168 | 75,785,644 |

Source: ESA administrative data

The list of the largest projects in which the Canadian space sector was involved includes the ExoMars mission (€14.6 million) and the MetOp Second Generation mission (€4.5 million).

The average size of contracts was €519,582, and the vast majority of contracts were valued at €500,000 or less (see Figure 7).Footnote 9

| Distribution of contracts | |

|---|---|

| €100 K or less | 76 |

| €101 K to €500 K | 44 |

| €501 K to €1 M | 11 |

| €1 M to €5 M | 16 |

| €5 M or more | 2 |

Source: ESA administrative data

In terms of distribution over time, Figure 8 indicates that the Canadian space sector has received between €13 million and €18 million worth of contracts from ESA during each of the five fiscal years. This means, on average, approximately $23 million in ESA contracts provided to the Canadian space sector annually.

| - | - | - | - | - | |

|---|---|---|---|---|---|

| Distribution (€) | 13,319,577 | 16,856,367 | 15,049,129 | 12,504,602 | 18,055,968 |

Source: ESA administrative data – unweighted

The data also confirms that the space industry is, as intended, the main segment of the Canadian space sector involved in ESA contracts. As illustrated in Figure 9, Canadian space industries received 92% of the total value of ESA contracts and while 41 companies were involved in these contracts, the various divisions of MDA (Maxar) were by far the predominant driver, receiving a total of €36 million over the five year period. MDA's involvement in the ExoMars mission accounted for approximately half of this amount (€18.5 million). In addition, 15 Canadian universities received funding from ESA to participate in its activities (for a total of €5 million), as well as two federal departments: Environment and Climate Change Canada and the National Research Council (for a total of €1 million).

| MDA (Maxar) | Other private industries |

Universities | Federal departments and agencies |

|

|---|---|---|---|---|

| Distribution (€) | 35,636,253 | 34,078,331 | 5,012,333 | 1,058,727 |

Source: ESA administrative data

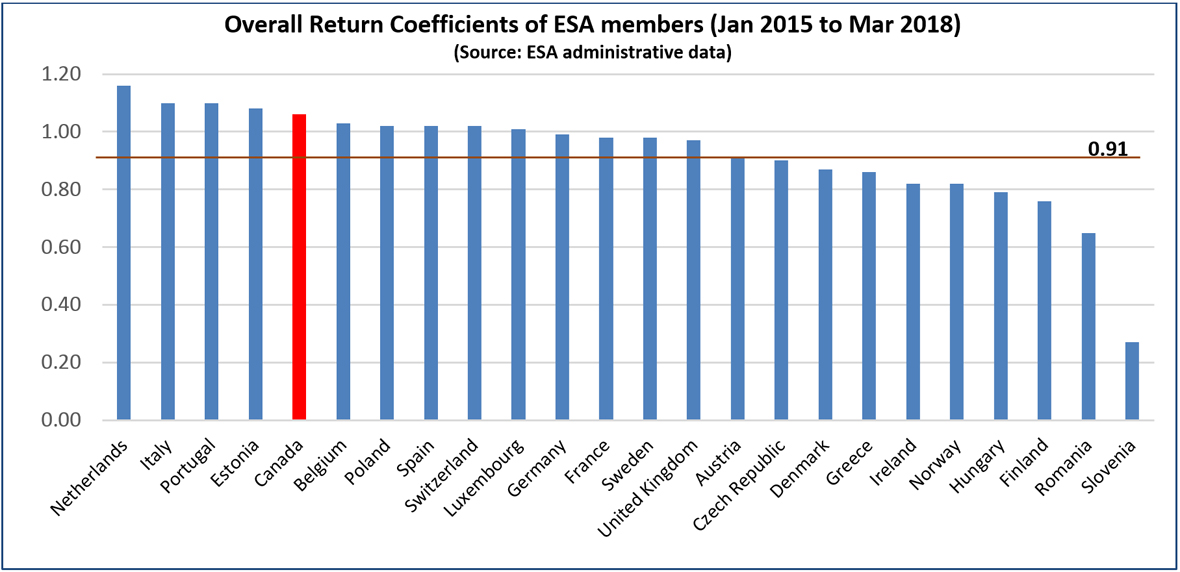

4.2.1.4 Geo-return achieved by Canada

As previously noted, the ideal overall industrial return to be achieved by all ESA member states by the end of the applicable reporting period () is 1.00. In progressing towards this goal, ESA expects all member states to achieve, at a minimum, an overall industrial return of 0.91 by . As indicated in Table 4, Canada is well positioned to achieve this interim goal, as its overall return coefficient stood at 1.06 as of .

| Programming domains | Return coefficient |

|---|---|

| Overall return coefficient | 1.06 |

| Mandatory programmes and activities | 0.63 |

| Earth observation | 1.02 |

| Microgravity and human spaceflight | 1.57 |

| Telecommunications | 1.08 |

| Projects not yet associated to a domain | 0.98 |

Source: ESA administrative data (ESA, 2018c)

In fact, and as illustrated in Figure 10, Canada is among the ESA member states that are achieving the highest return coefficient, well above the 0.91.

Figure 10

Figure 10 - Text version

| Overall Return Coefficients | |

|---|---|

| Netherlands | 1.16 |

| Italy | 1.10 |

| Portugal | 1.10 |

| Estonia | 1.08 |

| Canada | 1.06 |

| Belgium | 1.03 |

| Poland | 1.02 |

| Spain | 1.02 |

| Switzerland | 1.02 |

| Luxembourg | 1.01 |

| Germany | 0.99 |

| France | 0.98 |

| Sweden | 0.98 |

| United Kingdom | 0.97 |

| Austria | 0.91 |

| Czech Republic | 0.90 |

| Denmark | 0.87 |

| Greece | 0.86 |

| Ireland | 0.82 |

| Norway | 0.82 |

| Hungary | 0.79 |

| Finland | 0.76 |

| Roumania | 0.65 |

| Slovenia | 0.27 |

Source: ESA administrative data

Canada has traditionally been in a position to achieve the targeted return coefficient rates. Looking back at the previous reporting period ( to ), Canada had reached an overall return coefficient of 1.09 by the end of (CSA, , p. 49), before landing at 0.99 by the end of (CSA, , p. 33).

The mandatory programmes and activities is the one domain where Canada has faced some challenges in achieving a fair return. As noted by key informants during interviews, Canada's geographic location excludes Canadian contractors from a number of potential activities that would typically be covered under the mandatory activities (provision of certain goods and services, maintenance of facilities, etc.). However, measures have been taken over time to ensure that Canada can achieve a fair return for its contribution to the general budget of ESA. The most significant one, initiated back in , was the allocation of ESA contracts to the Canadian industry to participate in the Deep Space antenna project. In fact, and as noted in the evaluation of the ESA-CP, the participation of Canada in this project lead to an over-return coefficient, which was corrected through an additional contribution by the CSA to ESA (CSA, , p. 33).

4.2.2 Benefits of the ESA-CP

Finding: The ESA-CP is a mature program that continues to perform well in contributing to the achievement of its expected results. It provides strategic intelligence on European space activities, it provides opportunities to advance Canadian space technologies, and it positions the Canadian space sector in European and other foreign markets. These results benefit both the Canadian space sector and the CSA in the implementation of its own programs. (Evaluation question: Performance #3)

4.2.2.1 The consistent performance of the ESA-CP

As illustrated through its logic model (see Figure 3 on page 9), the following benefits are anticipated to derive from Canada's participation in ESA through the ESA-CP:

- The CSA and other federal departments will use the information gathered through Canada's participation in the various boards and committees of ESA to inform their decision-making processes and policy development. By having a detailed understanding of the range of programmes implemented by ESA and its member states, the CSA and other federal departments and agencies that use space-based solutions would be in a position to plan their activities in light of this strategic information.

- The Canadian space sector will actively participate in ESA missions and activities, which in turn, will increase the number of alliances formed (both commercially and scientifically); enhance the technological capabilities of the Canadian space sector; and provide access to ESA data and infrastructures.

- Overtime, the Canadian space sector will enhance its competitiveness in European and other foreign market, which will also enhance its capacity to meet the requirements associated with the missions and activities undertaken by the CSA and other departments and agencies involved in space activities.

The and evaluations

Both the and the evaluations of the ESA-CP concluded that the ESA-CP has contributed to the achievement of these results (CSA, , ). The following key findings emerged from these two evaluations:

- Procurement achievements: The strong return coefficients achieved by Canada demonstrate that the Canadian space sector is in a position to successfully operate within the procurement policy of ESA. The Canadian space industry has effectively engaged with European prime contractors or directly led projects.

- Strategic information and data: As summarized in the evaluation of the ESA-CP, "there was near consensus among CSA and OGD representatives interviewed that Canada's participation in ESA Programme Boards and horizontal committees provides the CSA and OGD with invaluable information and intelligence" that support their decision-making processes (CSA, , p. 35). Canadian scientists also benefit from the privileged access to data and information that derives from their participation in ESA's missions. These scientists include both academics and government scientists, who use the data from ESA missions for fundamental research or operational needs (weather forecast, monitoring activities, etc.).

- Commercialization of new technologies: Canadian companies participating in ESA missions are given the opportunity to advance their technologies (higher Technology Readiness Levels (TRL) achieved), and to space qualify them as applicable, which strengthens their capacity to commercialize them, particularly in the areas of telecommunications and Earth observation. This participation also leads to alliances between Canadian and European companies that allow for further collaborations on projects beyond the ESA realm.

- Economic benefits: Using an input-output model to assess the economic benefits resulting from ESA contracts given to Canadian companies, the evaluation concluded that the $114.2 million in ESA contracts given between and yielded total direct, indirect and induced economic benefits of $447.9 million in GDP and 4,582 person years of employment (CSA, , p. 53).Footnote 10

In terms of challenges, both evaluations noted that the level of funding provided by Canada in optional programmes was limiting the capacity of some companies to engage in a larger number of ESA missions and activities. In other words, some companies were unable to compete for some opportunities as a result of the fact that the Canadian funding in the applicable optional programmes was already committed. This was particularly emphasized during the period covered by the evaluation, as the CSA had first reduced its funding to the ESA-CP in (in the area of telecommunications), before increasing it in , which made it more challenging for the industry to adjust to these fluctuations.

The – period

The trends that emerged from this evaluation are largely consistent with these findings, which illustrates the fact that the ESA-CP is a mature program that does contribute to the achievement of its intended outcomes. During the – period, the Canadian space sector continued to be actively engaged in ESA missions and activities, as illustrated by the strong industrial return coefficient achieved. Scientists from both academia and government have also served on ESA scientific committees and used the resulting information and data to support their research activities. The opportunities provided by ESA have advanced Canadian technologies and led to other commercial endeavours beyond ESA. Also, Canadian representatives on ESA boards and committees have gathered strategic intelligence regarding not only ESA, but also each of its member states, which is serving well the planning activities of ESA, and of the other segments of the Canadian space sector.

The issue of the funding level for the ESA-CP was also raised by key stakeholders during this evaluation. Findings confirm that, indeed, the capacity of the Canadian space sector to engage in some of the activity areas of ESA is arguably exceeding the contribution level provided by Canada to the associated optional programmes. This, in itself, speaks to the strength of the Canadian space sector in key areas of space technologies. However, the logic of the ESA-CP has never been to support all potential projects from ESA in which the Canadian space sector could potentially engage in. It is rather to provide opportunities for such a participation to occur, with the goal of strengthening the positioning of the Canadian space sector to engage in foreign markets generally, in addition to better supporting CSA missions and activities by applying the technologies developed as part of these ESA programmes. As of -, the CSA was investing 12.5% of all its programming resources in the ESA-CP (CSA, 2017a, p. 28, 2017b, p. 28). Whether this allocation is adequate in light of all the priorities of the CSA is a relative question that falls beyond the scope of the evaluation.

The next sub-section provides more details on some of the results achieved by the ESA-CP over the period covered by the evaluation, and how they relate to findings included in previous evaluations of the program.

4.2.2.2 Highlights of the period covered by the evaluationFootnote 11

The following examples are intended to provide practical illustrations of the results achieved by the ESA-CP, but they are not meant to be an exhaustive list of all results achieved.

Consultations held with the Canadian space sector